Global payments. Simplified.

Join Paycov waitlist.

Peer-to-peer transfers, QR & NFC tap-to-pay, chat payments, instant card issuance.

Everything you need for modern payments

Powerful features designed for the Moroccan market

Peer-to-peer transfers

Instant money transfers

Send and receive money instantly with anyone—no bank account required.

QR & NFC payments

Pay anywhere, cash-free

Pay for taxis, groceries, shopping, and more with just your phone. No more cash—just scan a QR or tap to pay instantly and securely, wherever you go.

Chat-based payments

Send money in a chat

Request or send payments directly in your conversations—fast and intuitive.

Instant card management

All your cards, one wallet

Add, manage, and use multiple cards securely from any Moroccan or international bank.

Transaction history

Track your spending

View detailed transaction history and manage your finances with real-time insights.

Top-up options

Top up with cash, cards, or agencies

Add funds easily—use your bank card or visit partner agencies, no credit card needed.

Built for Morocco's Financial Inclusion

No bank account? No problem. Top up with cash at thousands of partner locations across Morocco.

How Paycov Works

Start your cashless journey in minutes

Sign Up & Join the Waitlist

Register your interest to be among the first to experience Paycov when we launch.

Verify Your Identity

Complete a quick, secure KYC process—fully compliant with Moroccan regulations.

Fund Your Wallet, Your Way

Top up instantly using your Moroccan bank card or with cash at partner agencies—no credit card needed.

Pay, Send, or Request—Anywhere

Enjoy instant peer-to-peer transfers, chat payments, and pay in-store with QR or NFC—no cash required.

Get Your Card

Access your virtual card immediately and order a physical card for worldwide use.

Sign Up & Join the Waitlist

Register your interest to be among the first to experience Paycov when we launch.

Verify Your Identity

Complete a quick, secure KYC process—fully compliant with Moroccan regulations.

Fund Your Wallet, Your Way

Top up instantly using your Moroccan bank card or with cash at partner agencies—no credit card needed.

Pay, Send, or Request—Anywhere

Enjoy instant peer-to-peer transfers, chat payments, and pay in-store with QR or NFC—no cash required.

Get Your Card

Access your virtual card immediately and order a physical card for worldwide use.

Ready to go cashless?

Join thousands of Moroccans already waiting for the future of payments. Be among the first to experience true financial freedom.

Experience Paycov

See how easy payments can be.

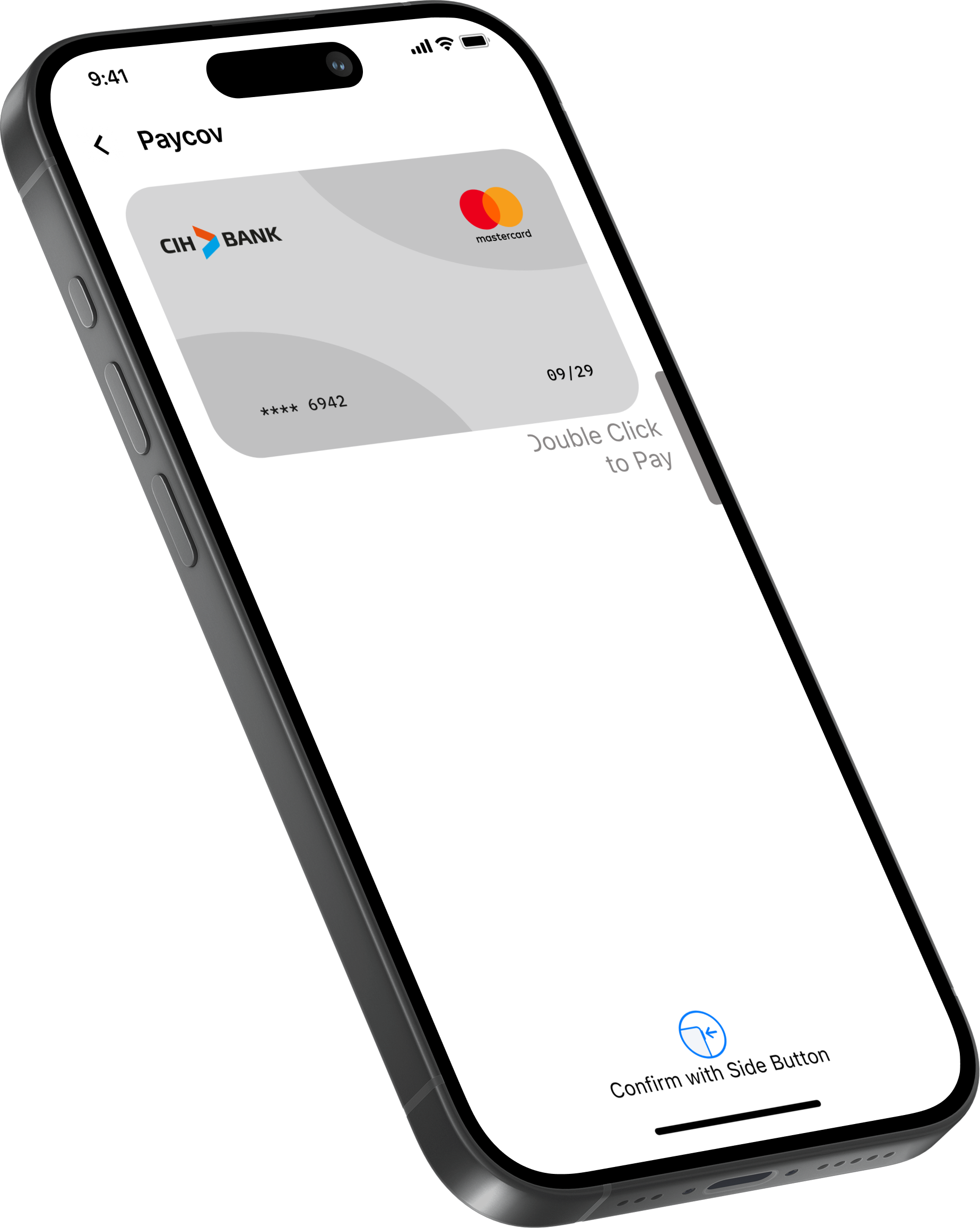

NFC Tap-to-Pay

Tap your phone to pay instantly—no cash or card needed. Perfect for taxis, shops, and everyday purchases.

Key Features:

👈 Swipe left or right to explore features 👉

Built for everyone

For Individuals

Your money, your way—simple, secure, and cashless.

Instant transfers

Send and receive money in seconds—no bank account required.

Truly cashless payments

Pay for taxis, groceries, shopping, and more, all with your phone.

Bank-level security

Every transaction protected with advanced encryption and fraud prevention.

Top up your wallet, your way

Add funds from cards, cash agencies, or transfers—accessible to all.

Global reach

Use your Paycov card anywhere, anytime—even as a tourist or expat.

For Businesses

Grow your business with seamless digital payments.

Accept payments instantly

Let customers pay with QR, NFC, or chat—no special hardware needed.

Easy integration

Connect Paycov to your store or website with our simple API and plugins.

Reach new customers

Join Morocco's fastest-growing cashless network and attract locals and tourists.

Fast, reliable payouts

Get paid quickly through trusted Moroccan bank partnerships.

Smart business tools

Access real-time analytics and transaction history to manage and grow your business.

Ready to go cashless?

Join thousands of Moroccans already waiting for the future of payments. Be among the first to experience true financial freedom.

Top Up Your Way

Flexible options for everyone, everywhere in Morocco

Major Moroccan Banks

Instant bank top-up

Link your account with any major Moroccan bank for fast, secure wallet funding.

Cash Agencies Network

Top up with cash nearby

Add money at trusted partner agencies—perfect for the unbanked and cash earners.

Partner Outlets

Convenient store top-ups

Recharge your Paycov wallet at supermarkets, convenience stores, and local shops.

ATM Withdrawals

Access cash anytime

Withdraw funds at partner ATMs or agency locations whenever you need cash.

Partnership Development

Banking partnerships and cash agency network currently being established. Full list of partners will be available at launch.

Your Money, Secured

Bank-grade security and full regulatory compliance—your peace of mind comes first.

Segregated Accounts

Your funds are always safe

Your funds are held separately at regulated Moroccan banks—never mixed with operational funds.

End-to-End Encryption

Military-grade protection

Every transaction and all your data are protected with industry-leading encryption technology.

Verified Identity

Secure KYC compliance

We use secure, streamlined KYC to meet Moroccan AML/CFT standards and keep your account protected.

Regulatory Approval

Fully licensed operation

Paycov is fully licensed and operates under the direct oversight of Bank Al-Maghrib.

Security by the Numbers

Your Security is Our Priority

We've built Paycov with the highest security standards, ensuring your money and data are always protected.

Protected Funds

Your money is safeguarded in segregated accounts at licensed banks

Data Privacy

Advanced encryption keeps your personal information completely secure

Regulatory Compliance

Full compliance with Moroccan financial regulations and oversight

Regulatory Notice

Paycov is in the process of obtaining a payment institution license under Bank Al-Maghrib. Services subject to regulatory approval. Identity verification required per Moroccan AML/CFT regulations. Funds held in segregated accounts at regulated banks. Terms apply.

Join the Revolution

Be part of Morocco's cashless future with Paycov

Why Join Paycov?

Early Adopters Community

Shape Morocco's digital payment landscape and get exclusive early access.

Trusted Bank Partnerships

Backed by leading Moroccan banks for secure, seamless transactions.

Beta Launch: Q3 2025

Experience Paycov before anyone else—help us perfect the platform.

Our Roadmap

Q1 2025

Regulatory approval process

Q2 2025

Banking partnerships finalized

Q3 2025

Beta launch with early users

Q4 2025

Public launch across Morocco

Q1 2025

Regulatory approval process

Q2 2025

Banking partnerships finalized

Q3 2025

Beta launch with early users

Q4 2025

Public launch across Morocco

Ready to experience the future?

Frequently Asked Questions

What is Paycov?

Paycov is Morocco's all-in-one digital wallet, enabling you to pay, send, and receive money instantly—no cash or credit card required. Use it for in-store, online, and peer-to-peer payments, with full support for Moroccan and international cards.

How do I top up my Paycov wallet?

You can top up instantly via Moroccan bank cards, at partner cash agencies, or at participating stores and outlets across Morocco. No bank account? No problem—just visit a cash agency.

Is Paycov secure?

Absolutely. Paycov uses bank-level encryption, segregated accounts at regulated Moroccan banks, and strict KYC/AML compliance. Your money and data are protected at every step.

Where can I use Paycov?

Paycov is accepted at a growing network of merchants, including taxis, groceries, cafes, and online stores. You can also send money to anyone with a Paycov account—friends, family, or businesses.

How do I get a Paycov card?

Once your account is verified, you can access a virtual card instantly for online payments, and order a physical card for in-store and international use.

Can businesses accept Paycov?

Yes! Businesses can accept Paycov payments in-store (QR/NFC), online, or via chat. Integration is simple, and settlement is fast through Moroccan bank partners.

How do I join the waitlist?

Simply sign up with your email or phone number on our website to reserve your spot for early access and updates.

Who can use Paycov?

Paycov is built for everyone in Morocco—individuals, businesses, tourists, and the underbanked. All you need is a smartphone and a valid ID for verification.

What are the fees?

Paycov offers transparent, competitive pricing. Basic peer-to-peer transfers are free, and business transactions have low, flat fees. Full pricing details will be available at launch.

When will Paycov launch?

We're targeting a beta launch in Q3 2025, subject to regulatory approval and banking partnerships. Waitlist members will get early access and regular updates on our progress.

Still have questions?

Our team is here to help. Get in touch and we'll get back to you as soon as possible.